Experience Verify firsthand

Access our testing environment for 100 free API calls

No integration, no hassle, no payment needed.

Eight identity verification categories. One unified API call and risk score.

Fideo combines diverse, dynamic data sources with advanced AI to deliver a complete view of identity in real time, at a fraction of the cost of traditional methods.

- Synthetic identity checks

- Email checks

- Breach checks

- Identity, sanctions, government ID checks

- Phone checks

- Digital checks

- Location checks

- IP address checks

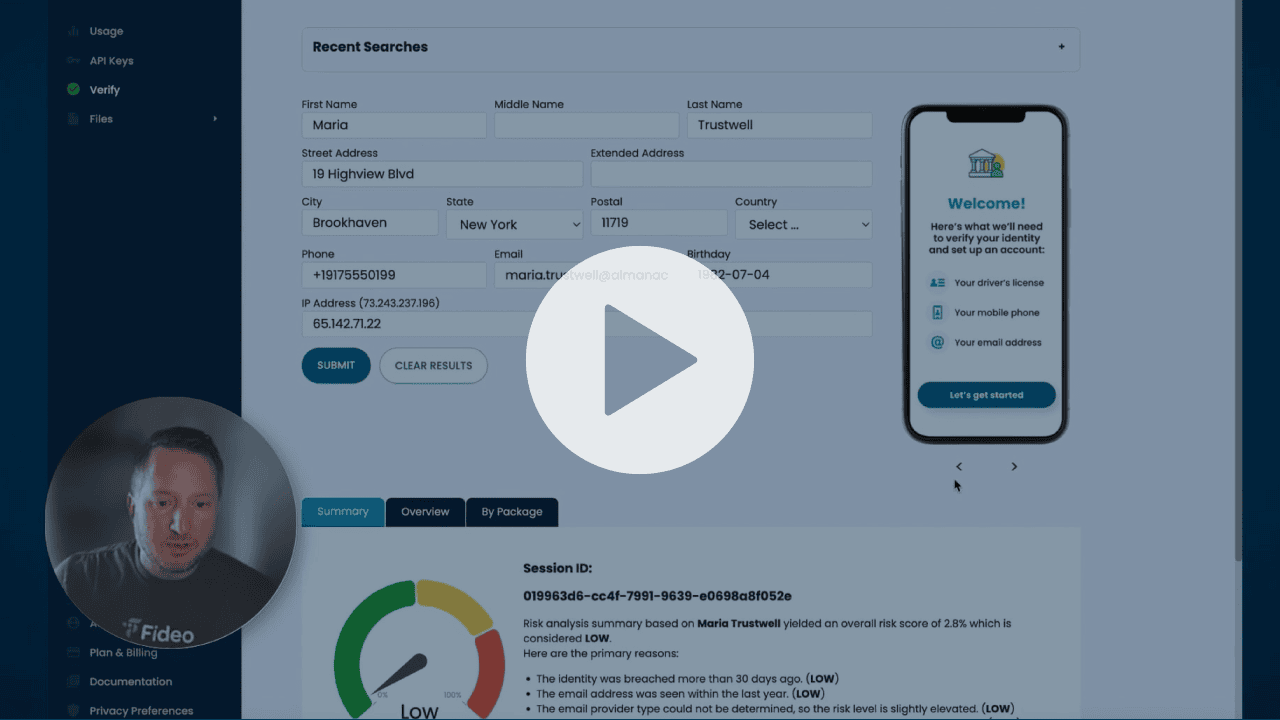

Verify Demo (5:16)

See Fideo Verify in action and walk through a typical

working session.

How to test Verify

Sign up to explore our demo environment and start running real-time identity checks.

The Verify test environment is a guided sandbox—explore the solution without technical setup. Start by looking up yourself, then mix in valid and fake details to see how the risk scores change.

Easy access

Instant access to a guided sample UI to run real identity checks

Unified risk score

Single risk score from 8+ categories of identity checks

Instant results

No integration and no payment info needed for testing

1

Enter your business email.

2

Access the sample UI test environment.

3

Test your own data or recreate known fraud scenarios with sample data.

4

Receive clear risk scores with category-level reasons.

The benefits

More identity checks. Less fraud. Half the cost. Instantly usable. Endlessly scalable.

- Lower verification and regulatory costs

- Reduced fraud losses and false positives

- Faster onboarding

- Better user experience

- Comprehensive, consolidated risk scores

- Real-time, actionable risk insights

- Continuously updated data

- Simplified per-session pricing

50%

reduction in cost

47%

more risk detected

18B

new inputs per month

24/7

continuous updates

Simplified, per-session pricing

Fideo Verify offers per session pricing rather than per call—you pay once per user session for unlimited checks.

Free evaluation

$0/month

- No credit card required

- No integration needed for testing

- 100 free sessions

- Full access to verification platform

- 8 fraud categories

- Real-time feedback

- Dynamic risk scoring

- Fraud summary description

Professional

$499/month

- Up to 30,000 sessions per year

- Unlimited calls per session

- Full access to verification platform

- No-code interface for testing

- 8 fraud categories

- Real-time feedback

- Dynamic risk scoring

- Fraud risk descriptions by attack vector

- Personal account support

Enterprise

Contact us

Reach out to our team today to discuss your goals, get personalized recommendations, and explore pricing options that fit your needs.