Identity intelligence built for modern payments

Reduce fraud and onboarding friction across KYC workflows with upstream identity signals

95 billion

fraud attempts blocked annually

47%

more fraud detected

2+ billion

identity records referenced globally

<1 second

response time

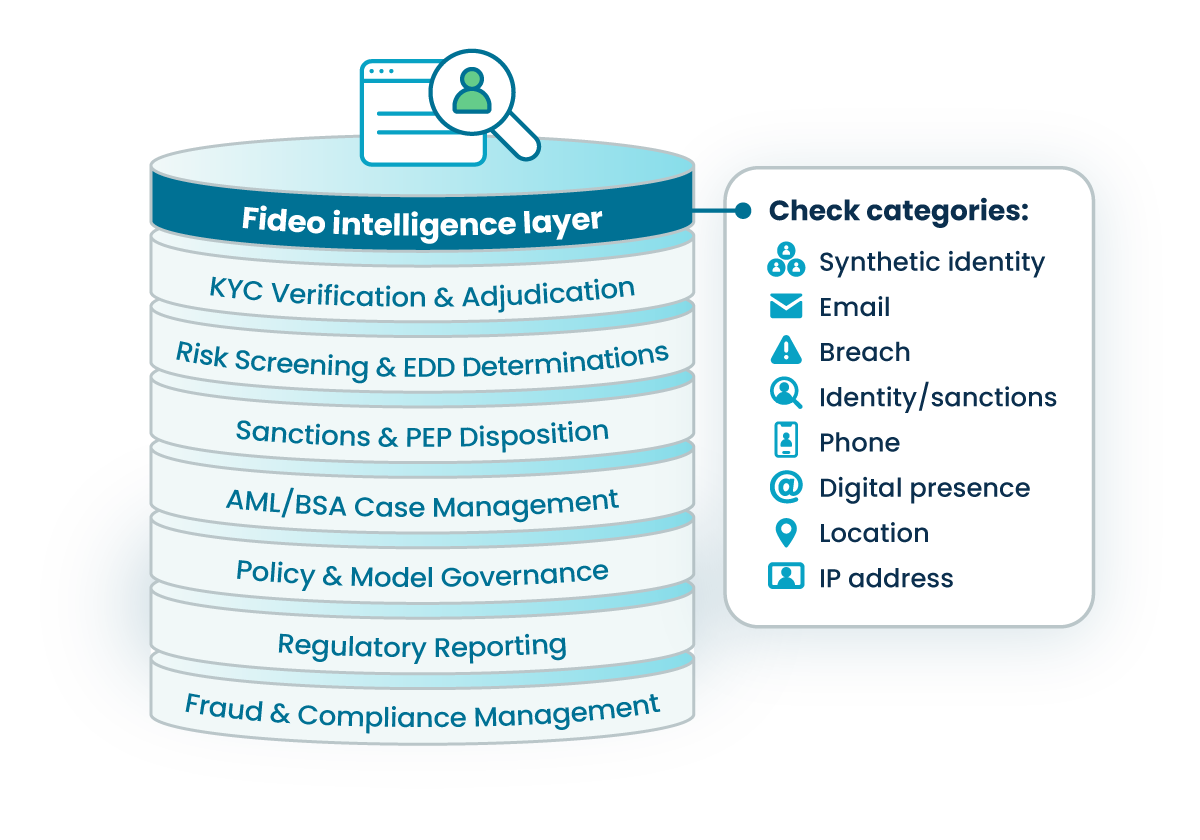

Improve fraud signals across payment workflows

Implement Fideo upstream of your KYC and compliance stacks

Improve the quality, consistency, and reliability of identity signals before they enter regulated workflows, strengthening downstream screening, verification, and decisioning processes.

Catch fraud earlier and reduce downstream exception handling

Identify risk earlier in the lifecycle and scale workflows without scaling manual review, reducing investigation queues and operational burden.

Faster growth, lower losses, and fewer manual reviews

Fideo boosts approval rates and operational efficiency by strengthening identity and fraud signals at the earliest point in the customer lifecycle.

Approve more legitimate customers with less friction

Improve conversion while maintaining strong controls and a consistent customer experience.

Reduce false positives and reviewer workload

Detect risk before expensive KYC checks and manual reviews while improving match accuracy and explainability.

Reduce losses from synthetic identity and account abuse

Surface identity risk before bad actors reach payment flows or exploit account lifecycle gaps.

Move faster through bank and enterprise diligence

Provide transparent, defensible signals that support program reviews and third-party assessments.

Audit-ready fraud intelligence for regulated workflows

Strengthen KYC, sanctions, and PEP workflows with better upstream inputs, supporting risk-based controls without shifting decision accountability.

Improve audit defensibility through explainable signals and consistent outcomes that document how and why risk was identified.

Reduce exception-handling burden by cutting review queues caused by thin files, unclear matches, or inconsistent identity data.

Modern APIs built for payment scale

Integrate payment fraud screening in minutes, not months

Fideo plugs into your payments and risk stack fast—enhancing existing workflows with auditable sessions and explainable outputs that keep customer friction low.

API-first integration, live in minutes

Deploy Fideo into onboarding and risk workflows using modern, real-time APIs designed for payment-grade throughput and reliability.

Explainable outputs for smoother workflows

Get clear signals, reason descriptions, and supporting context to improve routing, review, escalation, and downstream decisioning.

Built for your existing stack

Fideo augments—not replaces—KYC/CIP providers and case management tools, enabling rapid integration without rearchitecting compliance systems.

Session-based workflows

Fideo Session IDs stitch multiple calls into one billable, auditable session, simplifying cost planning and auditability.

curl -X POST \

https://api.fideo.ai/signals \

-H 'Authorization: Bearer {Your API Key}' \

-H "Content-Type: application/json" \

-d '

{

"emails": [

"[email protected]",

"92d01f8a6c5f6ad97cd9b9b7912ba0e8"

],

"phones": ["+19175550199"],

"profiles": [

{

"service": "x",

"username": "mariatrustywell",

"url": "https://x.com/mariatrustywell"

}

],

"name": {

"given": "Maria",

"family": "Trustwell",

"full": "Maria A. Trustwell"

},

"organization": "Northwind Mutual",

"title": "VP, Deposit Risk",

"location": {

"addressLine1": "19 Highview Blvd",

"city": "Brookhaven",

"region": "New York",

"regionCode": "NY",

"postalCode": "11719",

"country": "United States",

"countryCode": "US"

},

"ipAddress": "179.43.159.201",

"birthday": "1982-07-04"

}

{

"risk": 0.8797062189019102,

"checks": [

{

"id": "BREACHED_IDENTITY_COMPROMISED",

"state": "MED",

"name": "Identity Compromised in last 30 days",

"description": "The identity has been compromised in the last month, which could indicate a medium potential fraud attempt.",

"risk": "MED",

"checkPackage": "Breached"

},

{

"id": "IDENTITY_OFAC_LIST",

"state": "INPUT_NAME",

"name": "Input name matches OFAC list",

"description": "The input name matches the OFAC list, indicating some risk.",

"risk": "MED",

"checkPackage": "Identity"

},

{

"id": "IP_GEOLOCATION_MISMATCH",

"state": "TRUE",

"name": "IP geolocation mismatch",

"description": "The IP geolocation does not match the provided address, indicating a potential fraud attempt.",

"risk": "HIGH",

"checkPackage": "IP Address"

},

{

"id": "IP_TYPE",

"state": "TOR",

"name": "TOR Node detected",

"description": "A very high-risk IP, as Tor and anonymizers are commonly linked to privacy-conscious users but are also frequently associated with criminal activity, malware, and fraud attempts.",

"risk": "HIGH",

"checkPackage": "IP Address"

}

]

}

Resources

Talk with an expert or request a demo

Ready to protect your payment flows?

Connect with us to request a demo, or start with a free, no-hassle evaluation.