Account origination & onboarding fraud prevention

Stop fraudulent identities before KYC and credit checks

95 billion

fraud attempts stopped yearly

47%

more risk detected

2+ billion

globally validated individuals

<1 second

to see results

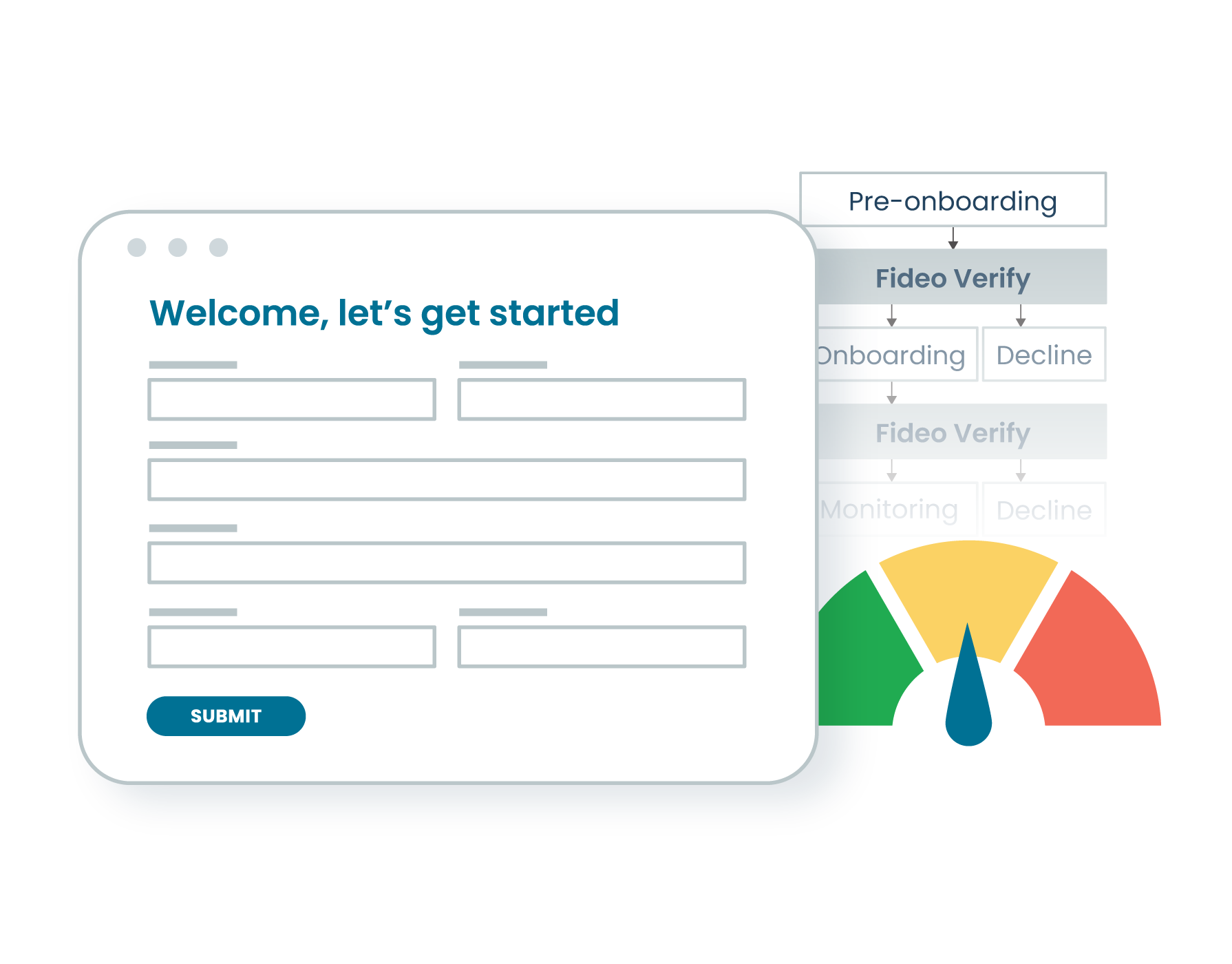

Fideo Verify

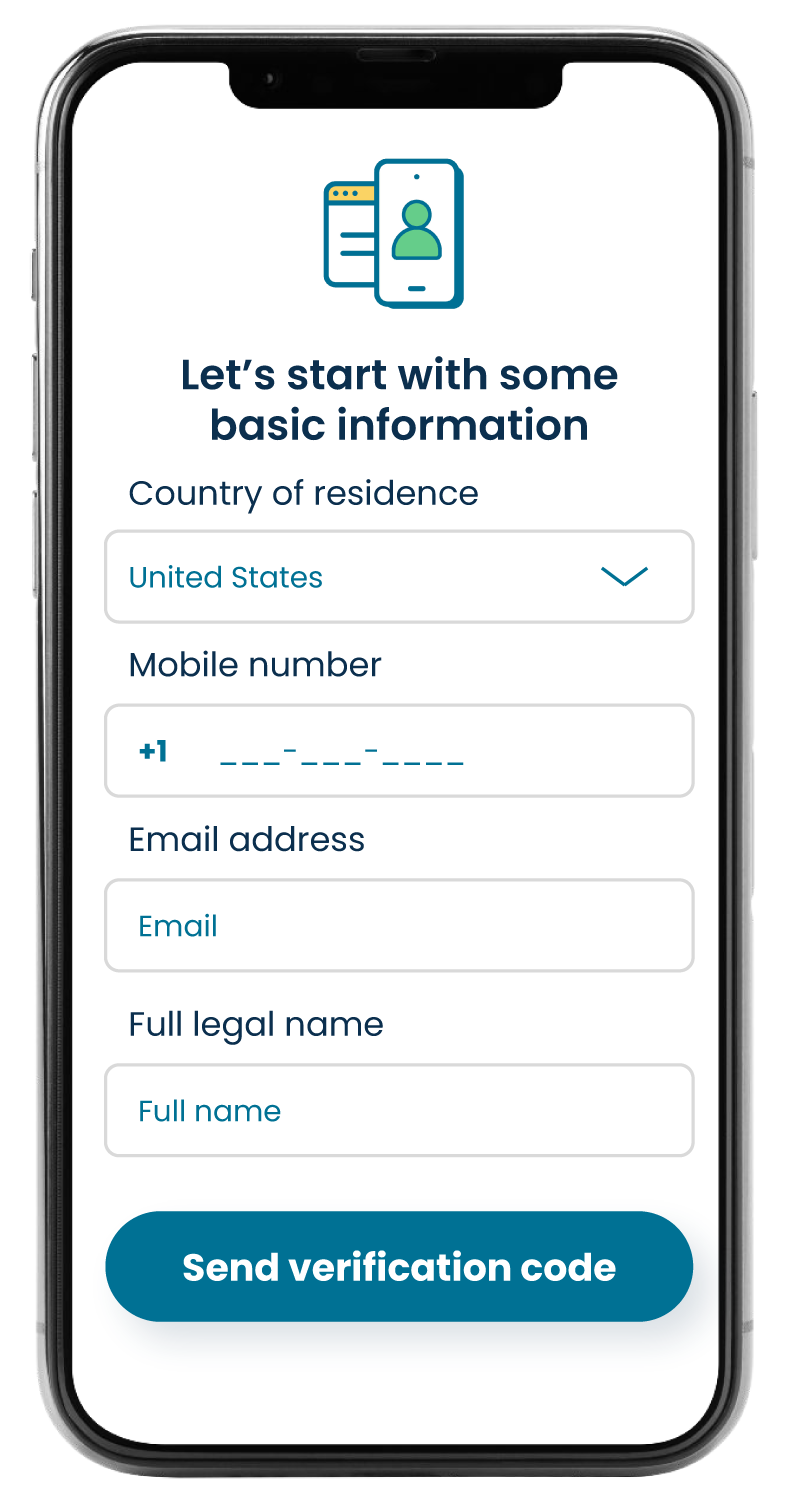

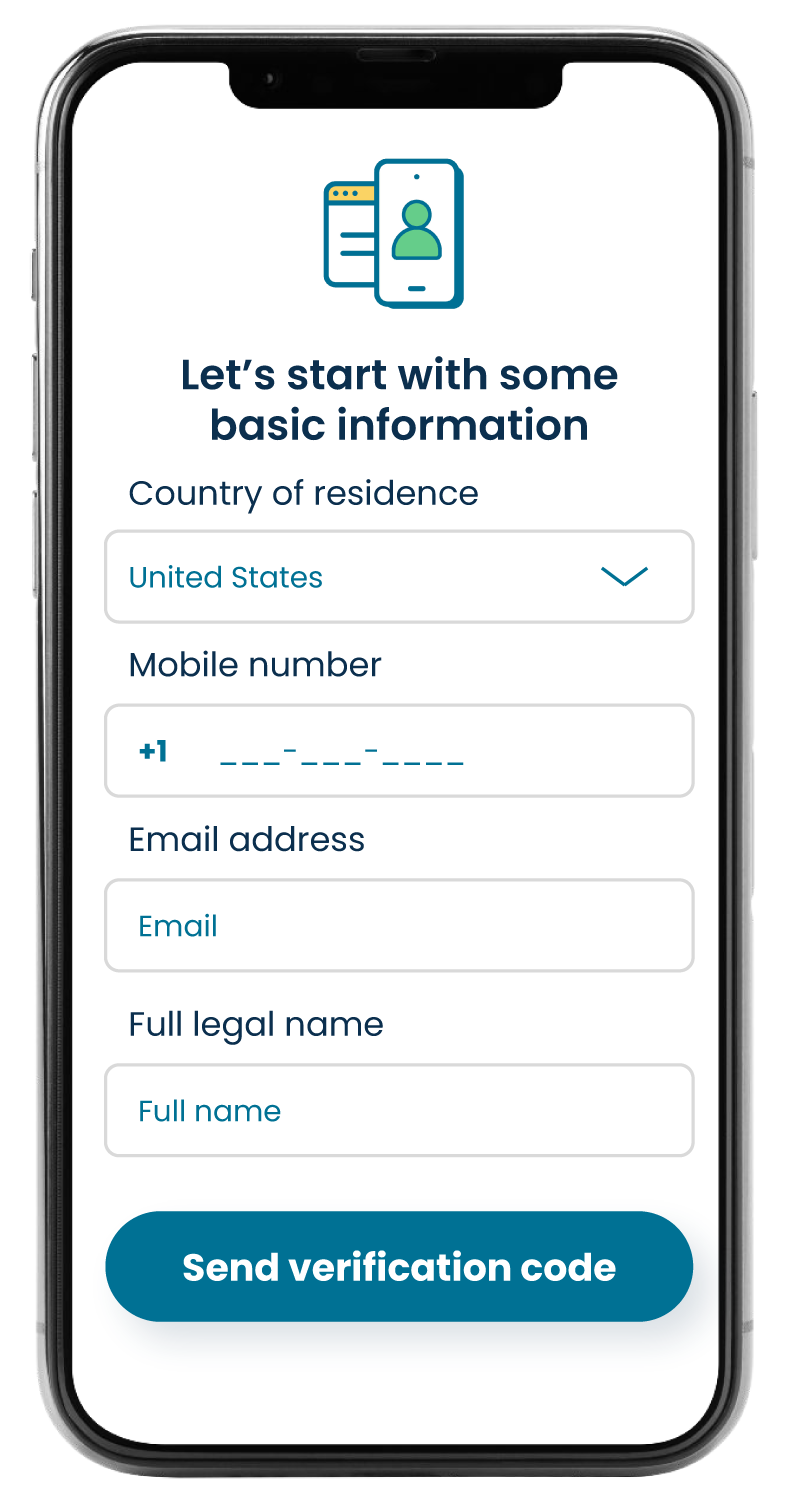

Streamlined verification for account opening

Plug Fideo Verify into your existing workflows, delivered as a real-time API designed for modern SaaS and banking stacks.

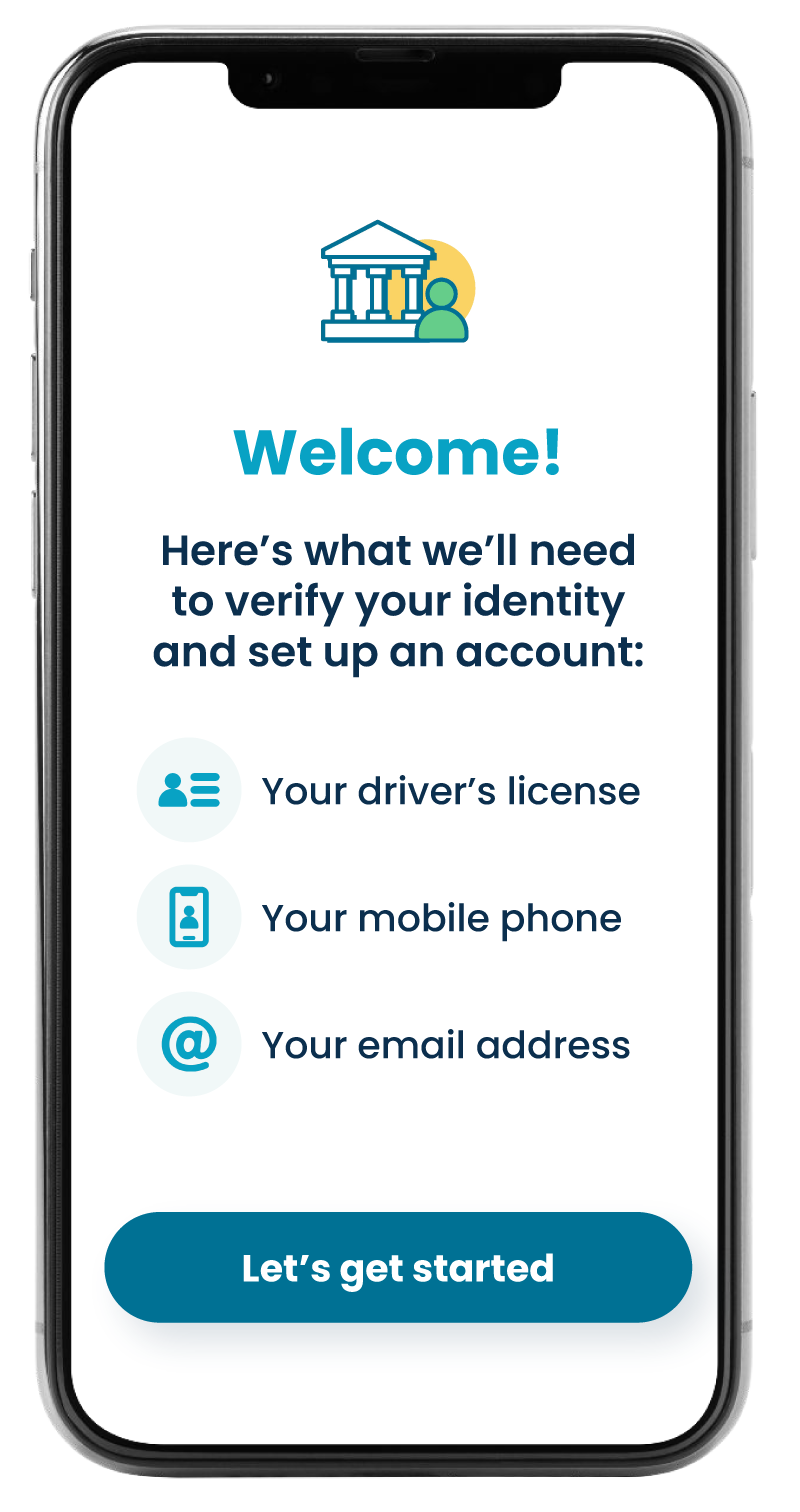

Pre-onboarding

Onboarding

Monitoring/review

Pre-onboarding

Fideo: Pre-onboarding fraud checks

- IP address / digital intelligence check

- Device check

- Location check

- Device/behavioral analytics

Onboarding

Fideo: Onboarding fraud checks

- Synthetic identity

- Breach risk

- Email risk

- Banned list check

- Identity risk

- Phone risk

- Digital presence

- Location checks

- Document verification

- Live Video verification

- Behavior biometrics

Monitoring/review

Fideo: Risk monitoring/manual review

- Lookup previous sessions

- Enrich profile

- Identity graph risk assessment

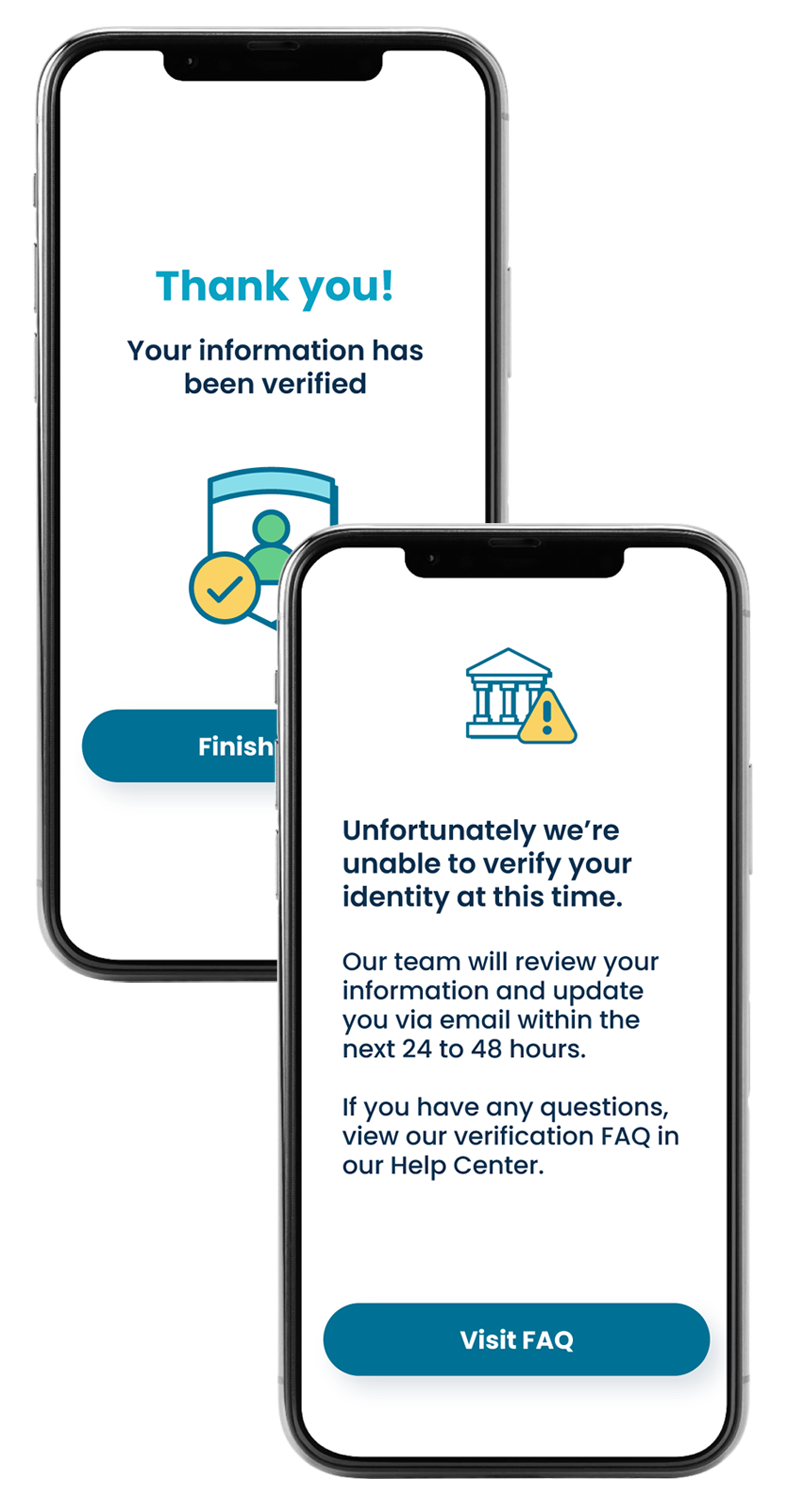

Stop bad accounts before they enter your ecosystem

Block synthetic accounts pre-KYC

Spot risky applicants in milliseconds with email, phone, device, IP, and digital footprint checks.

Improve unit economics on every new account

Fewer fraud losses, fewer wasted checks, and a cleaner funnel from application to active customer.

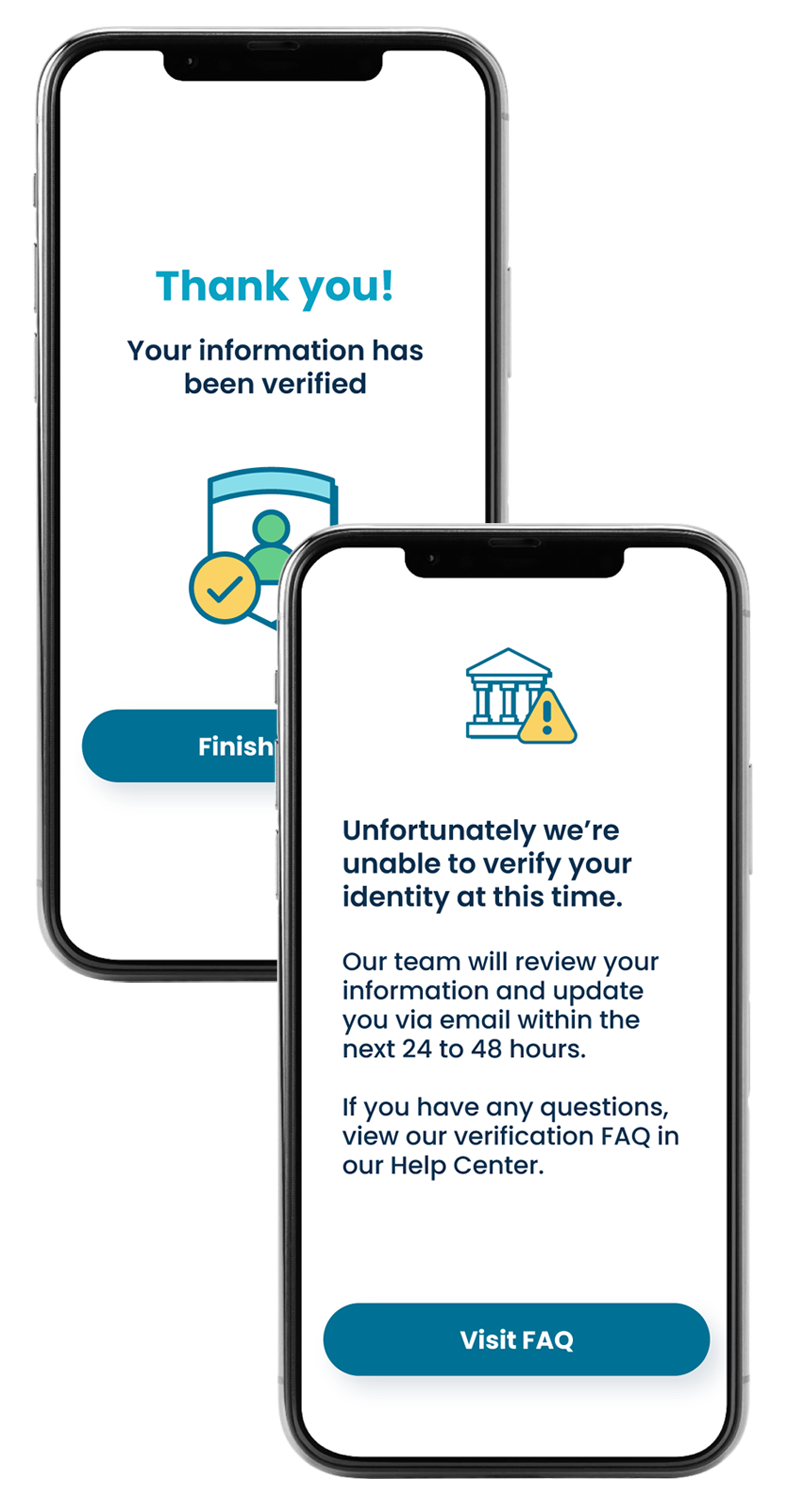

Approve more good customers with less friction

Use a single risk score to fast-track low-risk applicants and only step up the small slice that looks suspicious.

Lower KYC & biometric spend

Filter out obviously bad or low-intent sign-ups so you’re not paying for documents, selfies, or third-party checks on doomed accounts.

Developer-first by design

Integrate entity verification in minutes, not months

Fideo Verify is built for teams that need powerful identity and entity intelligence without complex integrations. Our developer-first platform delivers real-time verification, fraud signals, and risk insights through a single, unified API—so you can move fast while meeting security and regulatory requirements.

Fast to implement, live in minutes

Deploy core identity verification and risk scoring with a lightweight integration designed to get you to production quickly.

Client- and server-side SDKs

Prebuilt SDKs make it easy to integrate Fideo Verify across web, mobile, and backend environments.

KYC-grade verification, powered by real-time signals

Go beyond static checks with dynamic identity intelligence that helps detect fraud, reduce false positives, and support regulatory compliance.

A single API that scales with you

Start with identity verification and expand seamlessly into broader fraud and risk use cases—without additional integrations or vendor sprawl.

curl -X POST \

https://api.fideo.ai/verify \

-H 'Authorization: Bearer {Your API Key}' \

-H "Content-Type: application/json" \

-d '

{

"emails": [

"[email protected]"

],

"phones": ["+19175550199"],

"profiles": [

{

"service": "x",

"username": "mariatrustywell",

"url": "https://x.com/mariatrustywell"

}

],

"name": {

"given": "Maria",

"family": "Trustwell",

"full": "Maria A. Trustwell"

},

"organization": "Northwind Mutual",

"title": "VP, Deposit Risk",

"location": {

"addressLine1": "19 Highview Blvd",

"city": "Brookhaven",

"region": "New York",

"regionCode": "NY",

"postalCode": "11719",

"country": "United States",

"countryCode": "US"

},

"ipAddress": "65.142.71.22",

"birthday": "1982-07-04"

}

{ "risk": 0.6137062189019102, "checks": [ { "id": "BREACHED_IDENTITY_COMPROMISED", "state": "MED", "name": "Identity Compromised in last 30 days", "description": "The identity has been compromised in the last month, which could indicate a medium potential fraud attempt.", "risk": "MED", "checkPackage": "Breached" }, { "id": "IDENTITY_OFAC_LIST", "state": "INPUT_NAME", "name": "Input name matches OFAC list", "description": "The input name matches the OFAC list, indicating some risk.", "risk": "MED", "checkPackage": "Identity" }, { "id": "PHONE_DNO_TEXT", "state": "UNKNOWN", "name": "Do not text not available", "description": "Do not text information not available", "risk": "LOW", "checkPackage": "Phone" } ] }

Why Fideo at origination (vs. KYC alone)

Be proactive, not just compliant

Stopping fraud at origination prevents bad actors from ever entering your ecosystem, instead of trying to catch them with KYC after the fact.

Stay ahead of modern, sophisticated fraud

Synthetic identities, bot farms, and mule networks can bypass traditional KYC checks. Origination-level signals give you the context to stop more fraud earlier.

Lower downstream and operational costs

Blocking fraudulent accounts at onboarding prevents future charge-offs, investigations, and support overhead across the customer lifecycle.

Improve customer experience

Reduce manual reviews and false declines, so legitimate customers enjoy smoother, faster onboarding.

Resources

Talk with an expert or request a demo

Ready to protect your account origination funnel?

Connect with us to request a demo of Fideo Verify or try the API in a test environment with free evaluation calls.